Air, Freight News

E-commerce delivers Christmas surprise but is it sustainable?

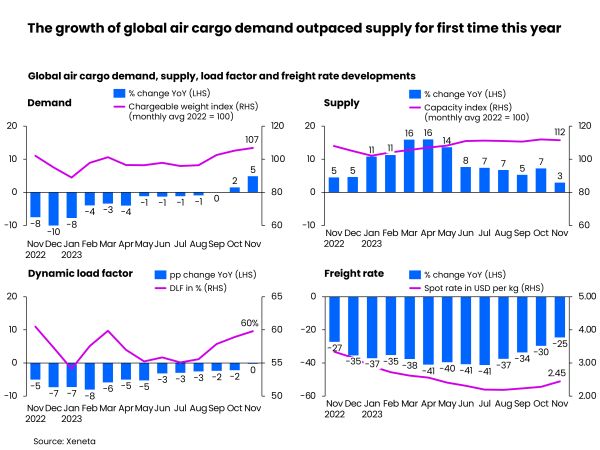

[ December 7, 2023 // Chris Lewis ]A surge in e-commerce volumes from Hong Kong and China inflated global air cargo demand by +5% year-over-year in November as US and European consumers splashed out on low-cost products, said says Oslo-based analyst Xeneta in its report published in December. However this growth failed to disguise the underlying subdued nature of the market nor did it quell concerns over its sustainability heading into 2024

E-commerce behemoths Shein and Temu almost single-handedly accounted for the rise in volume and rates out of Hong Kong and China in November, creating some welcome ‘havoc’ in an air cargo market devoid of a traditional peak season.

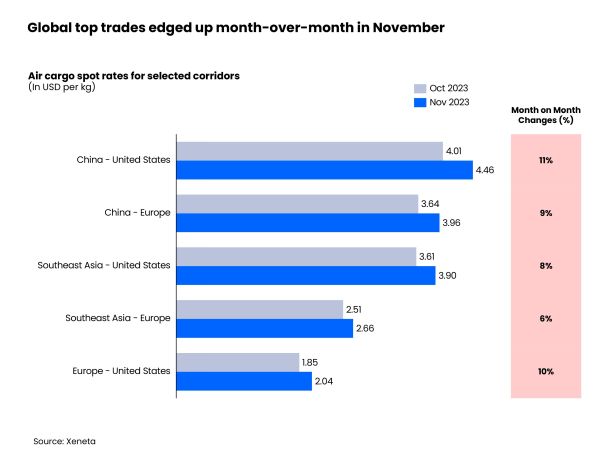

China to the US spot rates outpaced their October growth of +10%, climbing +11% month-over-month to US$4.46 per kg. Spot rates from China to Europe followed a similar upward trend, rising to $3.96 per kg, up 9% from a month ago.

These increases contributed to an overall +7% month-on-month improvement in the global air cargo spot rate, which averaged US$2.45 per kg in November, compared to +2% in October. Available capacity rose +3% year-on-year.

Demand slightly outpaced supply and helped to push the global dynamic load factor to 60%, which is on a par with its corresponding level of a year ago.

This though must be seen in context due to comparison with the state of the global air cargo market in November 2022, says Xeneta’s chief airfreight officer, Niall van de Wouw.

He said: “We don’t see November’s data as a fundamental shift in the economy nor the outlook for 2024 for the global air cargo market.

“Seasonality means volumes are up, admittedly slightly more than we expected, but the figures also look better than they really are because November last year was disappointing for airlines and forwarders alike. More than anything else, what we saw this November was air cargo’s growing dependency on e-commerce.”

Van de Wouw continued: “November’s growth was strongly influenced by ex-China volumes driven by two companies. You rarely have a conversation with an airline or forwarder right now that doesn’t reference Shein or Temu because these two e-commerce behemoths seem to be upsetting the market by themselves, supposedly accounting for some 80% of airfreight volumes ex-Hong Kong on certain days.

“In a tight market, you only need a slight imbalance to push rates up because of the ‘fear of missing out’ that we have referenced previously. This seems to be happening out of China and Hong Kong, which are experiencing quite a boost in rates.

“The big question is: how long can this last? Airfreight is a key part of the e-commerce model because it relies on speed. This need for capacity is creating quite a bit of havoc in the market – but this is a local shift and not a bellwether for a changing global economic tide. It is more related to US and European consumers buying more lower value goods from these vendors.

“The improvement is not being driven by an increase in shipments of higher value products, and this is a worry for airlines and forwarders. E-commerce produces big volumes but how can you, in a sustainable manner, deliver an $8 t-shirt to someone’s doorstep from China to the US and make money across the entire supply chain? Even the vendors delivering these goods question its long-term viability.”

Xeneta’s latest analysis of the general cargo market shows continuing weak demand, extending a downward trend since the last week of September this year.

Aligned to this, global general cargo spot rates (valid for up to one month) have been staying below seasonal rates (valid for over one month). Under the backdrop of a still-subdued general cargo market, air cargo spot rates for outbound Asia markets grew more slowly compared to October, while the growth of Southeast Asia to Europe and Southeast Asia to US air cargo spot rates slowed down to 6% and 8% respectively, reaching US$2.66 per kg and US$3.90 per kg respectively.

While air cargo spot rates from Europe to the US rose – up +10% month-over-month to US$2.04 per kg in November – the increase was mainly driven by the reduction of belly capacity during carriers’ winter season.

Global airfreight capacity will likely continue to outpace market demand next year. This is due to anticipated weak consumer spending at least in H1 2024 and a continuing recovery in belly capacity for certain markets next year, boosted by improving passenger travel.

The Civil Aviation Administration of China, for example, expects international passenger flights to be restored to 70% of their 2019 level in this winter season ending in March 2024, from the October level of 51%. And, the temporary visa exemption for citizens of five European countries starting from 1 December may accelerate passenger travel further and fuel the recovery of belly capacity between China and Europe.

Tags: Xeneta