Air, Freight News

No Christmas turkey yet for cargo airlines as demand refuses to fly

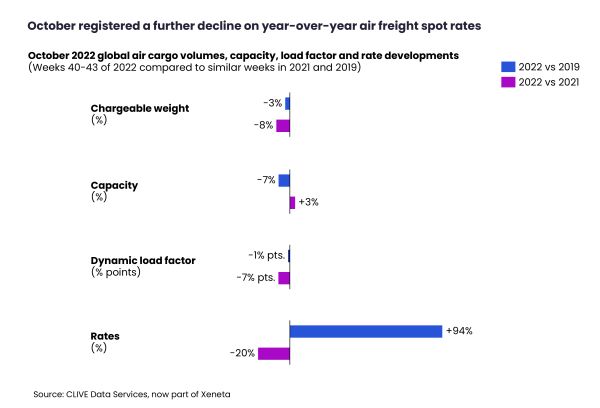

[ November 3, 2022 // Chris Lewis ]There’s no sign of an early Christmas for air cargo carriers says Xeneta-owned analyst CLIVE as volume carried declined -8% year-over-year in October – the eighth consecutive monthly fall – and there are no current signals to indicate an upturn in 2023.

The drop in demand, measured in chargeable weight, was also -3% below the pre-pandemic level in 2019.

Compared to last year’s levels, global air cargo capacity continued to recover in October but at a slower pace and remained -7% below the pre-Covid 2019 level. This contributed to a more subdued ‘dynamic loadfactor,’ CLIVE’s measurement of airline performance based on both the volume and weight perspectives of cargo flown and available capacity.

As falling demand meets rising capacity, load factors have been declining over the past 18 months. In October, the 61% dynamic loadfactor was -7% pts and -1% pts in comparison to 2021 and 2019 respectively.

October saw a second consecutive month of lower global airfreight spot rates below last year’s level.

Xeneta chief airfreight officer, Niall van de Wouw, commented: “We are six weeks away from Christmas and there is no indication there will be a peak. Demand worsened in October over the -5% reduction we reported in September, but this is not likely to surprise the market given the global economic outlook, although it’s clear that rates remain at a higher level than some observers would have expected in the current conditions.”

But he added: “Airfreight is certainly not currently suffering the decline of ocean, where Xeneta has recorded rate drops of 60%-70% in the last nine months. Ocean freight is responding to the market conditions much faster than air is and normalising quickly from a rates point of view.”

The outlook for air cargo remains uncertain, says Niall van de Wouw. “We don’t see a pressure on capacity, and we don’t see an increase in rates.

Looking ahead, he expects more challenges over the next 12 months: “I see very few signals that would support an increase in general airfreight in 2023 – be that because people have higher personal bills or because people are spending more on services relatively to goods.

“It is also fair to assume that even if consumers in Europe and North America were to buy exactly the same amount of goods in 2023 as in 2022, which is unlikely, then a higher portion of the transportation in support of that, whether it’s the finished products or the hard materials to make those products, is likely to move by ocean as a response of the higher reliability returning on the sea.”

Airfreight received a boost in the last two years because of the “incredible mess” in ocean freight, but shippers are now likely to feel more comfortable moving back to ocean from a reliability point of view. With all these factors combined, I don’t see where a lot of general freight growth demand drivers will come from.

“On the supply side, the opposite is true. People are becoming more comfortable about flying again and routes are opening up, leading to a rise in belly capacity, and the freighters being ordered and cargo conversions will also be coming to the market.

“The only development I can see that would slow down the decline in rates is supply on the ground. If airlines and cargo handling companies continue to struggle to hire people and remain short-staffed, then the bottlenecks will create an upward pressure on rates because it will be difficult to get your goods through the value chain.”

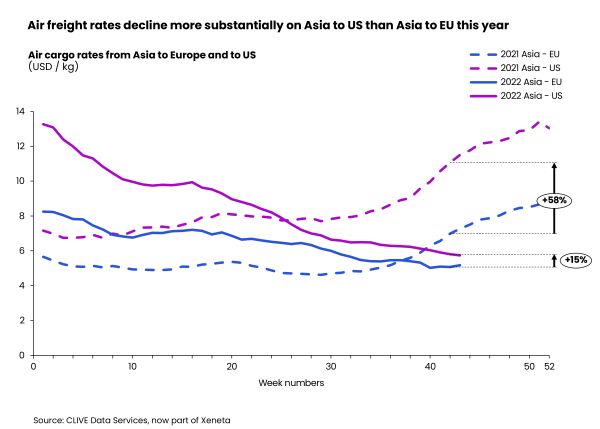

Airfreight rates on top volume corridors from Asia to Europe and Asia to the US continued to fall in October, while general rates fell more substantially on inbound US corridor routes than inbound Europe. This is attributed to added costs for EU routes, due to the closure of Russian airspace and lower spending by US consumers.

Europe to US airfreight spot rates stood at USD 3.11 per kg in October, down 27% from the 2021 level, while Asia to Europe spot rates fell USD 5.09 per kg, down 25% year-over-year. Asia to US registered the sharpest decline among the three top volume corridors, with the average spot rate down 45% from October last year to USD 5.87 per kg.

In comparison, the Latin America to US corridor showed more resilience to market headwinds, although its airfreight spot rate slid 11% to USD 1.38 per kg in October.

Shippers, however, may not be seeing long-term gains from falling airfreight rates right away, Niall van de Wouw says: “There is a lot of uncertainty, so this is not a period where shippers will get an ‘attractive’ deal for the next year or two years, they will get lower rates for the next one to two quarters, but who knows what will happen beyond that.”

Tags: CLIVE Data Services